Retirement draw down calculator

However you can take. Many clients purchase income annuities to help cover their essential expenses as defined by them in retirement.

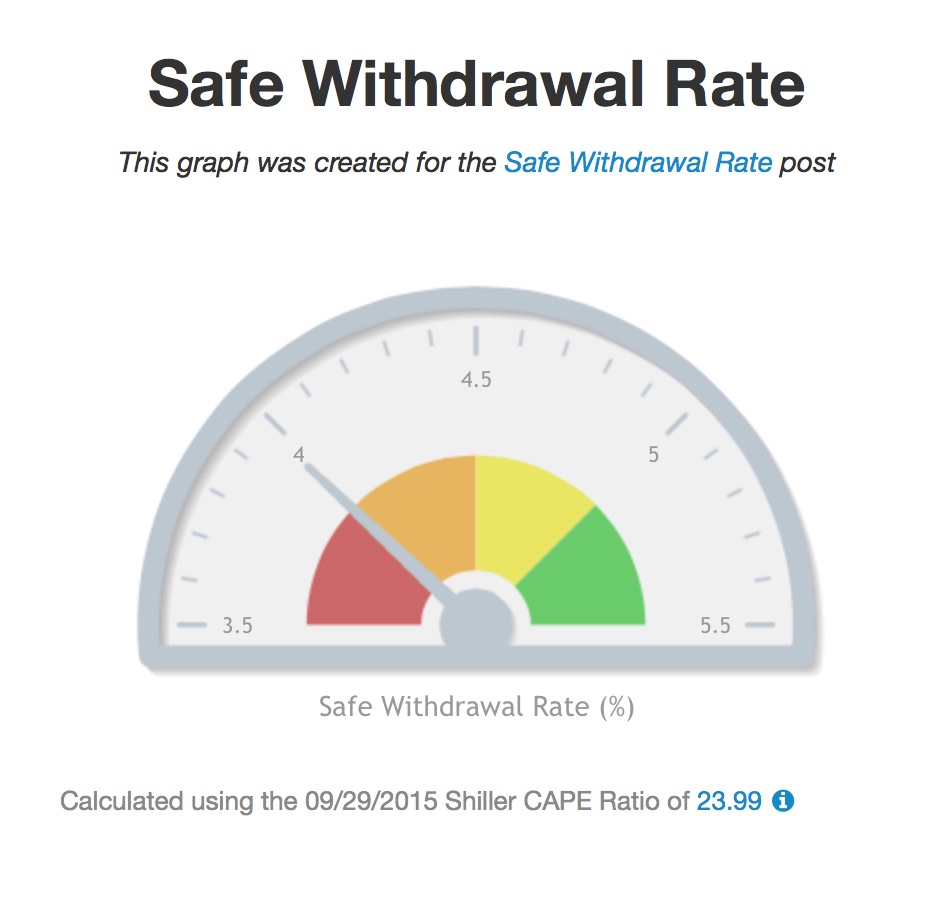

Safe Withdrawal Rate For Early Retirees

Variable percentage withdrawal VPW is a method which adapts portfolio withdrawal amounts to the retirees retirement horizon asset allocation and portfolio returns during retirementIt combines the best ideas of the constant-dollar constant-percentage and 1N withdrawal methods to allow the retiree to spend most of the portfolio using return-adjusted.

. It will help you to draw a map for your financial plan under few assumptions. She would spend her mornings calmly. The formal definition of normal retirement age applies to when and how you can access various types of retirement accounts.

You can forecast your retirement with or without NZ Super included. Early medical retirement. The calculator therefore does not take into account the sequence of returns risk when CPF members draw down on their portfolios for retirement income.

Annual return on investment is after taxes and inflation. Meet the unluckiest investor of. Most recent Simple Retirement Calculator Retirement Planning Retirement Income Savings and Investments Social Security Medicare and Health Insurance Aging Well Retirement Jobs Housing and Home Equity Reverse Mortgages Budgeting.

Taking your pension as a number of lump sums. While some folks in each age bracket are still working even retired individuals draw down their retirement over time. Each person has their own definition.

Use SmartAssets Social Security calculator to get an idea of what your benefits could look like in retirement. With the SP 500 SPX -337 down about 20 since the beginning of 2022 its useful to consider how it affects the retirement savings of todays workers. Play around with the calculator to get a rough idea of how much you can comfortably afford to borrow considering your income.

The three primary modes. Reserve component retirementthis pay is offered after 20 years of military service but is based on a points system which can include points for the following. Shopping around for pension income products and providers at retirement.

Your tires wear down on road trips bringing them that much closer to replacement. Current annual income is after taxes. This data comes from the Federal Reserves 2019 SCF.

If you draw money from a 401k. Input the cost of new tires including sales taxes and mechanic labor. Rely instead upon your.

PersonalFN Retirement Calculator is one of the most valuable online tool. Your net worth will never shrink. To my friend retirement meant the end of the early morning rush to complete the household chores and run to work.

And the more shares you sell today the fewer shares you will have left to take advantage of the eventual market. A HELOC calculator helps you see at a glance the maximum line of credit youd qualify for with loan-to-value ratios above the standard minimum of 80 percent. You can take into consideration your future source of income inflation growth rate of investments pre and post-retirement and so on.

The Best Retirement Planner voted By the AAII and others. Options for using your defined contribution pension pot. You will never draw down the principal.

It does not simulate the post-retirement period when you start to draw down your savings. These assumptions are then converted into the projections. Susannah Snider CFP is SmartAssets financial planning columnist and answers.

That can be done on this post-retirement fire calculator Rich. Tailor your retirement income plans to how much risk you can take and how much income you need. If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax due on each withdrawal.

However you can also consider a securities-backed loan. Taking your whole pension. If you contribute to your retirement plan during down times youll be purchasing investments at lower prices.

She would no longer have to devote the best part of her day to working at her desk with colleagues she had to put up with. What is flexible retirement income pension drawdown. Retirement is a dream for most Americans but without planning very few will realize it.

When the market reverses again your retirement plan value will increase as well because the prices of your existing investments will rise. Here we assume that youll continue to receive returns from investments and draw them down entirely. This calculator makes assumptions Your current annual expenses equal your annual expenses in retirement.

Income annuities can provide the confidence that you will have guaranteed retirement income for life or a set period of time. The calculator does not take into account variance in investment returns and instead assumes that investment returns are consistent across the years. She would make new friends.

It is a pre-retirement calculator that is useful before you retire to get a sense of how many years it is likely to take to accumulate enough money to retire. Use this income annuity calculator to get an annuity income estimate in just a few steps. Add any other streams of income you think youll.

It comes down to when you are ready and what your retirement goals are. You can sell off some of your assets to put a larger down payment on your home purchase. Have your financial advisor create a draw down strategy specific for your own particular risk tolerance and needs advises Timothy Shanahan president and chief strategist at Compass Capital Corporation in Braintree Massachusetts.

Get a plan that is right for you and your goals. See the net worth research post for details on the survey and how Im using it. Retirement pay in this case begins after the military members final out processing.

Active component retirementavailable to those who have completed 20 years of military service. What you define as normal may vary. Your tires might boast a 50000 mile warranty but dont expect them to last that long.

In 2015 the average retirement age was 64 for men and 62 for women. You will need to sell more shares in a down market than in a healthy one to come up with the cash you need. The greatest threat to your retirement account balance is selling shares when the stock market is falling.

Moving living and retiring abroad. And yes it makes sense for those older than retirement age to have savings.

The 10 Best Retirement Calculators Newretirement

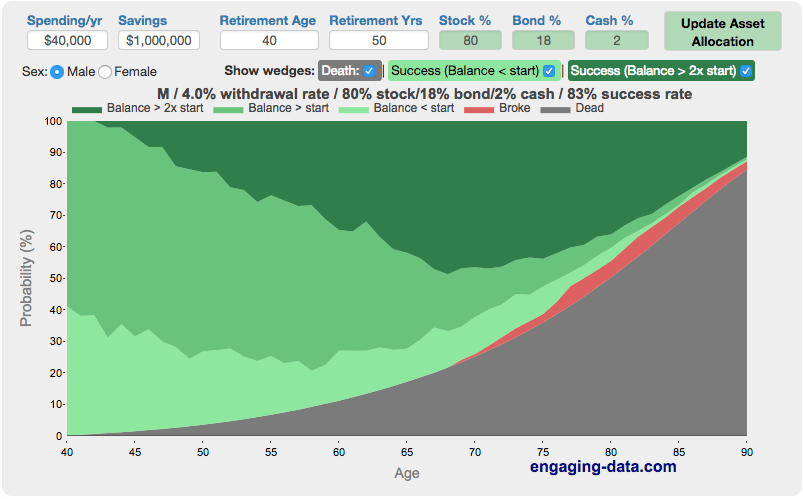

Fire Calculator When Can I Retire Early Engaging Data

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Retirement Savings Calculator

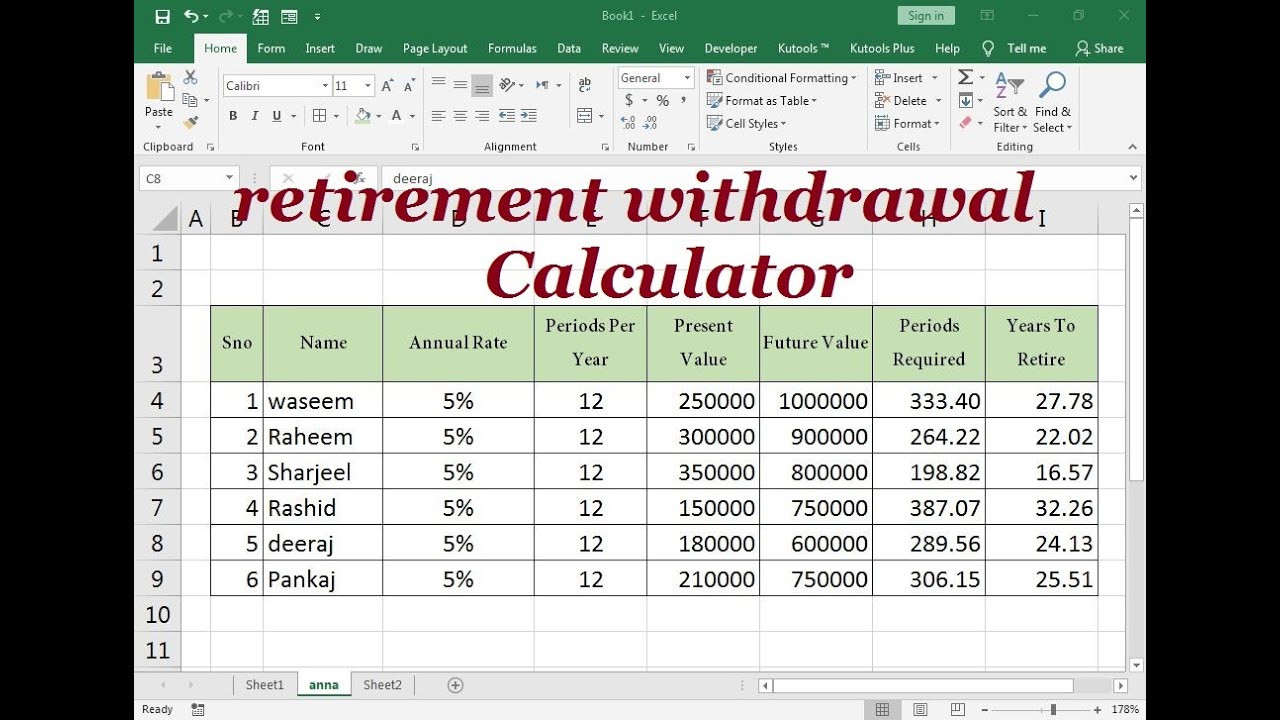

Retirement Withdrawal Calculator For Excel

Free 9 Sample Retirement Withdrawal Calculator Templates In Pdf

Retirement Withdrawal Calculator

Free 6 Sample Retirement Withdrawal Calculator Templates In Excel

Rich Broke Or Dead Post Retirement Fire Calculator Visualizing Early Retirement Success And Longevity Risk Engaging Data

Will You Have Enough To Retire The 4 Rule May Help Within Limits

Annuity Formula With Graph And Calculator Link

Free 6 Sample Retirement Withdrawal Calculator Templates In Excel

Free 6 Sample Retirement Withdrawal Calculator Templates In Excel

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Free 9 Sample Retirement Withdrawal Calculator Templates In Pdf

Retirement Withdrawal Calculator Excel Formula Youtube

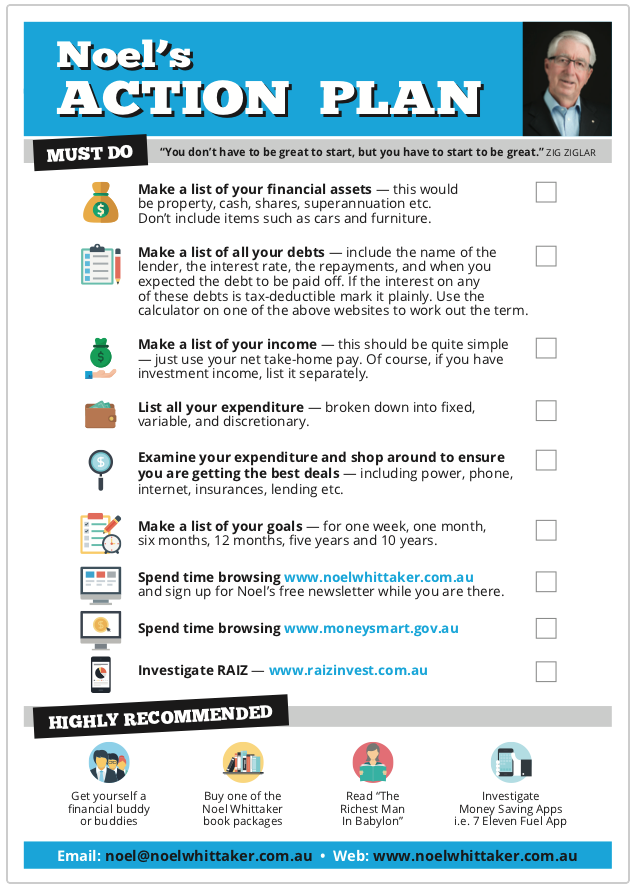

Retirement Drawdown Calculator Noel Whittaker